Business Email Compromise (BEC) is a rapidly escalating threat to organizations across all sizes and sectors, often bypassing even the most robust security defenses. While many small and medium-sized businesses (SMBs) in New Jersey’s healthcare, finance, legal, and pharmaceutical industries invest in email security tools, the evolving tactics behind BEC are leaving damaging gaps. CEO fraud maneuvers, supplier scams, and carefully targeted phishing emails are responsible for billions in global losses annually, turning “just another email” into a potential business catastrophe. Understanding the nuances of BEC isn’t just important; it’s non-negotiable for businesses determined to protect sensitive data, financial assets, and their organizational reputation.

Recognizing the Subtle Warning Signs of Business Email Compromise

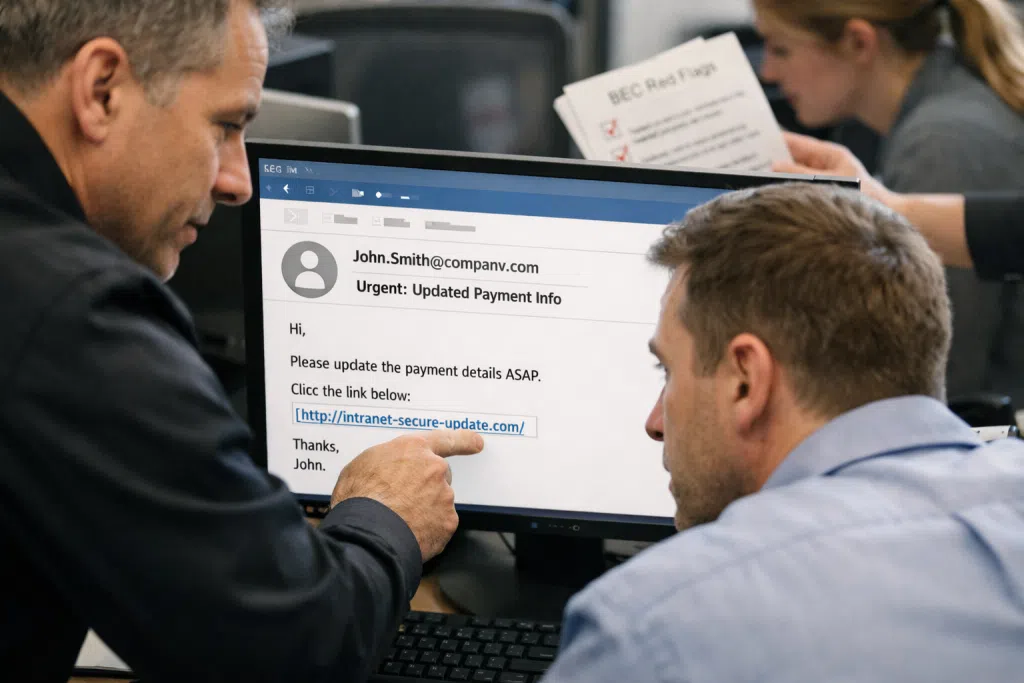

Unlike the clumsy scam emails of years past, today’s business email compromise attacks are subtle and sophisticated, often blending seamlessly with everyday correspondence. Attackers now employ social engineering, careful research, and even compromised supply chain partners to craft messages that mimic real internal requests. For teams dealing with pre-set routines, invoices, and finance approvals, these messages can be surprisingly convincing.

The modus operandi typically involves a bad actor gaining illicit access to, or entirely spoofing, the email account of a trusted individual. This could be a company executive, payroll coordinator, outside counsel, or even a frequent business partner. Attackers then send requests with legitimate context, such as transferring funds, updating payment information, or sharing confidential documents, driving hurried actions and minimizing questions.

Some warning signs to watch for in your inbox or workflow include:

- Sense of urgency or secrecy: Phrases like “transfer immediately” or “keep confidential” often feature in fraudulent requests.

- Unexpected changes to established payment instructions: Legitimate vendors rarely alter banking details without a transparent process.

- Mismatched email addresses: The sender’s name may look familiar, but hovering over the address reveals subtle misspellings or unfamiliar extensions.

- Odd requests outside business hours: Many BEC attempts happen late at night or over weekends, exploiting skeleton staff and reduced oversight.

- Slight deviations in grammar, tone, or formatting: Even with near-perfect English, impostors may overlook internal jargon or formatting habits.

A recent study published by the FBI’s Internet Crime Complaint Center shows the average BEC incident resulted in over $125,000 in losses per event for U.S. businesses in 2023. Source: FBI IC3 2026 Report. In regulated industries such as healthcare and finance, even one email slip can result in significant compliance fines and loss of customer trust.

For organizations with remote or hybrid workforces, the risks are even higher. Reliance on emails for approvals, remote payment processing, and document sharing creates more opportunities for threat actors to embed themselves in communication channels. Compliance requirements, such as HIPAA or FINRA rules, also dictate timely reporting and response, which can compound the impact of delayed detection.

Understanding these early signals is the foundation of building an effective email security posture. Even seemingly small variances, a reply coming from a new device, slightly updated sender signature blocks, or out-of-place urgency, should cue a second look. It’s this vigilance at the user level that forms the last line of defense against business email compromise, supplementing even the strongest technological shields.

To stay ahead of evolving threats, consult this in-depth guide on business email protection.

Dissecting How BEC Attacks Infiltrate Organizations

Email-based cybercrime thrives because it preys on both technology and human nature. Some BEC attacks begin with phishing, sending well-crafted emails to gather credentials from unsuspecting employees. Others rely entirely on social engineering, using public records, social media activity, or even previous data breaches to target executives, finance teams, and other high-level stakeholders.

In technical terms, a BEC campaign can be broken down into several core stages:

- Target Research and Reconnaissance: Attacker profiles an organization, identifying roles responsible for financial approvals or sensitive information. Online databases, company directories, and even social media posts become tools for attackers examining business structure and relationships.

- Initial Compromise: This may occur through a phishing simulation, malware-laden attachment, brute force login attempts, or exploiting weak passwords and inactive multi-factor authentication (MFA). A common scenario is credential harvesting where a convincing “password reset” or “account alert” email tricks an employee into giving up login details.

- Impersonation or Account Takeover: With credentials in hand, attackers either use the compromised account directly or set up a fake email address with slight domain modifications, mimicking a senior executive, legal counsel, or trusted supplier.

- Deception and Request: Attackers craft messages, for example, a request to change payment destinations for recurring vendors, or authorization to wire funds. Urgency and authenticity are carefully blended, referencing real projects or deals, occasionally backed by partial information from internal email threads.

- Execution: If the recipient complies, funds are transferred, confidential documents are released, or further credentials are obtained. In some cases, fraudsters set up inbox rules to conceal replies or forwards, preventing discovery until assets are long gone.

What sets BEC apart from spam or generic phishing is its personalized nature. Attackers may observe a compromised inbox for weeks, learning about ongoing deals, vendor relationships, or patterns in executive communication. Invoices are forged to match the formatting, tone, and timing expected by recipient teams.

An illustrative example: In 2023, a New Jersey law firm’s payroll department received an after-hours message from a senior partner’s compromised email account, requesting urgent changes to direct deposit instructions before payroll day. The email referenced a real client settlement, included the partner’s signature block, and arrived right after hours when fewer staff were present. The update was processed without question, leading to unauthorized transfers and a long, expensive recovery process.

Advanced email security software can flag some anomalies, but human error and trust in established workflows remain persistent risks. The key lies in combining technical controls with user awareness, treating each unexpected request for money or information as suspect until verified by independent means.

Organizations can also benefit from integrating artificial intelligence-based detection tools. These leverage behavioral analytics and pattern recognition to spot questionable requests, even when attackers mimic routine language or match internal formatting. As BEC tactics become more advanced, so must the blend of user education and intelligent security controls defending against them.

Critical Layers of Email Security Every SMB Needs

Victims of business email compromise often discover, in hindsight, that basic preventative measures were missing or poorly enforced. Effective email security is not a single product or software, but a multilayered approach designed to detect, contain, and recover from sophisticated threats. SMBs, particularly those handling regulated data, must evaluate their protection strategies with both compliance and evolving tactics in mind.

- Email Security Software: Modern secure business email platforms offer spam and malware filtering, encryption, and policy enforcement. Advanced solutions include features like machine learning-based anomaly detection, built-in impersonation protection, and customizable warning banners for external senders.

- Multi-Factor Authentication (MFA): Enabling MFA on all email accounts, especially for executives, finance, and IT staff, adds a critical barrier. Even if a password is compromised, attackers are often blocked from accessing the account directly.

- Outbound and Inbound Filtering: Outbound email scanning can halt unauthorized or suspicious messages from leaving internal accounts, helping detect compromised users. Inbound filtering detects external threats, including domain spoofing and malicious attachments.

- Phishing Simulation and Security Awareness Training: Technology cannot catch every threat. Regular, realistic phishing simulations help train staff to recognize warning signs, while ongoing education keeps users aware of new tactics.

- Privileged Access Management: Limit who can approve financial transactions or access sensitive information via email. Segregation of duties and role-based permissions reduces the risk that a single compromised account can inflict wide damage.

- Automated Incident Response: Leading email protection services include automated workflows for detecting suspicious requests, restoring compromised accounts, and notifying administrators of high-risk activity. The faster you can respond, the less damage can occur.

- Data Loss Prevention (DLP) and Encryption: For healthcare and legal firms, encrypting communications and configuring DLP policies ensures confidential data cannot be easily exfiltrated, even if an account is compromised.

- Secure Mobile & Remote Access Policies: With hybrid work models, enforcing secure email access on mobile devices, requiring endpoint protections, and segmenting business and personal accounts can help block high-risk entry points.

According to Gartner’s 2026 Market Guide for Email Security, attackers now regularly bypass first-generation email filters by exploiting weaker post-delivery controls and untrained users. Source: Gartner Market Guide for Email Security 2026. SMBs that combine strong technical controls with educated, empowered teams are far less likely to suffer damaging breaches.

Midway through your journey to improve protection? Don’t leave your business exposed, Connect with Blueclone Networks for tailored email security recommendations and ongoing support.

Practical Steps to Reduce the Risk of BEC for Regulated SMBs

Aware of the growing threat and financial fallout, more SMBs are moving beyond one-time training or basic spam filters. Managing BEC risk is now an ongoing process blending technical enforcement, clear policies, and a culture shift around email trust. For those in highly regulated sectors, additional legal and reputational stakes make these actions even more urgent.

- Review and Update Security Policies: Regularly revisit your organization’s email security, authentication, and incident response policies. Make sure all staff understand approved payment processes and escalation procedures for out-of-the-ordinary requests.

- Deploy Segmented Payment Approval Workflows: Never allow a single user to authorize and complete payments, especially via email. Implement multi-person authentication or back-channel confirmation for all financial movements.

- Run Frequent Phishing Simulations: Test all employees, not just top executives, by sending simulated phishing emails and tracking who engages. Use failed results for targeted education, not punishment.

- Enable Domain-Based Authentication (SPF, DKIM, DMARC): These domain authentication protocols prevent attackers from spoofing your business email domain. Set DMARC to a “reject” policy where possible, which blocks unauthorized emails from ever reaching inboxes.

- Log and Audit Access: All access to email accounts and sensitive workflows should be logged, with real-time alerts for suspicious or off-hours activity.

- Stay Informed About Vendor and Supply Chain Risk: Many BEC attacks exploit third-party suppliers. Routinely verify changes in vendor banking information through out-of-band calls or secure portals, not by replying directly to emailed requests.

- Regularly Update Email Security Software and Endpoints: Ensure all systems, including mobile devices, are running the latest security patches and software updates. Older platforms lacking modern protections cannot keep up with current tactics.

- Conduct Post-Incident Reviews: Every attempted BEC or phishing incident, successful or not, should result in a structured post-mortem. Identify user training gaps, security control weaknesses, and refine policies as a result.

For a healthcare or legal business, compliance mandates such as HIPAA not only require technical safeguards but also make ongoing user training and policy enforcement non-negotiable. The cost of non-compliance can include regulatory penalties, breach notification obligations, and lasting damage to reputation.

Adopting a layered approach, combining proactive user training, technical enforcement, and a zero-trust stance toward email-based requests, forms the most resilient defense. Business continuity plans should incorporate BEC scenarios, ensuring leadership and IT teams know how to contain and recover from attempted fraud or data exposure.

Choosing the Right Email Protection Services: What to Look For

With headlines frequently highlighting new BEC scams, many SMBs look to outsourced IT providers or dedicated email security software to close their protection gaps. Yet not all solutions are created equal. Selecting the right services and support makes the difference between a minor incident and a business-altering event.

Evaluate These Essential Qualities:

- Comprehensive Threat Intelligence: Your email security provider should have up-to-date data on both global and local BEC trends. Machines alone cannot counter tactics that change monthly; human expertise is still required.

- Integration with Existing Workflows: Whether your team relies on Microsoft 365, Google Workspace, or specialized legal/medical platforms, email security solutions must fit with minimal disruption.

- Customization for Regulated Industries: Look for solutions and teams experienced with HIPAA, PCI-DSS, FINRA, and similar compliance frameworks. Controls must align with your industry’s specific risk profile, not just generic best practices.

- Rapid Incident Response Support: Immediate access to remediation services when an incident arises. Time is critical for chasing down fraudulent transfers and containing data leaks.

- Ongoing Awareness and Training Programs: Providers should support or deliver regular phishing simulation exercises, policy reinforcement, and updated user education as part of their service.

- Seamless Cloud and AI Security Features: Today’s secure business email tools leverage AI-driven analytics, real-time anomaly detection, and zero-day attack detection without requiring heavy manual oversight.

For SMBs in New Jersey and the surrounding metro area, local expertise and the ability to offer quick on-site investigation should also be factors in the decision-making process. Businesses operating in healthcare, finance, and legal services may also benefit from tailored consulting on regulatory issues and audit preparation.

Partnering with a managed IT and cybersecurity provider brings the added advantage of continuous monitoring, policy adjustment, and hands-on incident management. Blueclone Networks, for example, offers a blend of compliance-focused IT, advanced email protection services, and actionable guidance specifically tuned for SMBs operating under strict regulatory frameworks.

Before committing to a solution, review case studies and testimonials relevant to your industry. Engage providers in direct discussions about their process for handling BEC scenarios, ask for documentation of incident response success and client education models.

Connect with Blueclone Networks now to explore business email compromise prevention tailored to your needs.

Frequently Asked Questions About Business Email Compromise

Business email compromise is more targeted and customized than traditional phishing. Attackers study an organization, learn internal language and workflows, and mimic trusted accounts to initiate specific financial, data, or credential transfers. Unlike spam, BEC often produces no obvious links or malware, relying on social engineering and insider data to succeed.

Always inspect the sender address for subtle changes, such as swapped letters or unfamiliar domains. Treat requests for urgent action, confidential information, or payment changes with suspicion, especially if the message tone is unusual. When in doubt, verify via a separate communication channel, such as a direct call or face-to-face confirmation.

Industries that frequently process financial transactions or sensitive legal/healthcare documents, such as finance, legal, healthcare, and pharmaceuticals, are top BEC targets. Attackers know these organizations handle large amounts of critical data regularly, and disrupting workflows can be costly or damaging.

Basic spam filters may catch low-effort campaigns, but most BEC attacks bypass generic filters. Attackers personalize messages and use compromised or spoofed internal accounts, which standard filters often let through. Advanced email security software and user awareness together provide real coverage.

Immediately stop any requested transactions or data sharing and alert your IT or cybersecurity provider. Change potentially compromised login credentials, review logs for unauthorized access, and follow your incident response policy. Timely reporting to law enforcement and regulators may also be required, depending on your industry and local laws.